What Is The Best Long Term Care Insurance Company To

What Is The Best Long Term Care Insurance Company

To selection long-term care insurance companies 2021, considered customer-satisfaction ratings J.D. Power' 2020 Individual Life Insurance Study scores. We looked financial strength demonstrated A.M. Best' ratings attribute, number complaints filed .

According American Association Long-Term Care Insurance, average cost long-term care insurance premiums a healthy married couple aged 55 costs $4,826 year (roughly $400/month). These numbers reflect policyholder initial benefit $164,000, a daily benefit $150 a -year benefit period.The company' traditional long-term care insurance plan a choice get long-term care coverage dollar, broadest range options care, .The Best Long Term Care Insurance Company Financial Strength Ratings. The average age people needing Long Term Care mid-80s. It vital choose a company today pay Long Term Care Insurance claim future .Best Overall : New York Life. Get a Quote. New York Life top mutual insurer United States offers long-term care coverage combination a life insurance policy stand- long-term care (LTC) insurance. In business 175 years, New York Life a financial strength rating A++ (Superior) AM Best .Mutual Omaha top long-term care insurance providers United States. You tailor a Mutual Omaha long-term care insurance policy a mix built- benefits optional benefit riders. Policy discounts include 15 30 percent savings. Read Review. (877) 882-7556 Free Quote.

Best Long Term Care Insurance

The Best Long Term Care Insurance [What Look For In LTC insurance] The long term care insurance company policy offers features flexibility, providing affordable premium.. When deciding companies policies, important options.The number insurance companies selling long-term care insurance plummeted 2000. Slightly 100 insurers selling policies 2004, 2020 data National .Long-term care insurance designed pay services offer kinds assistance: Custodial care: Support personal everyday tasks, bathing, eating bathroom Skilled care: Support a medical professional, a nurse therapist Most people picture types services place a nursing home, care happen *d*lt .

Health insurance doesn' cover long-term care expenses. Medicare cover long-term care costs, 100 days ( a 3-consecutive-day stay a hospital treatment). Medicaid cover long-term care expenses individuals assets $2,000 (countable assets Medicaid regulations; varies .As implies, MassMutual a nationwide mutual company offers a wide range life insurance, long-term care insurance, retirement, investment products. With long-term care insurance plans, elimination period— waiting period a policyholder receive benefits— generally 90 days.Best Long Term Care Insurance Washington

784/1000. New York Life top pick long-term care insurer financial stability. It superior financial ratings — -highest insurance company lists .

Long-term care insurance a specific type health insurance helps people pay long-term care. It covers types care included traditional medical plans, Medicare , .

What Is The Best Long Term Care Insurance Company

A.M. Best rating: A++ ("Superior") Massachusetts Mutual - "MassMutual" short - highest rated insurance companies America. They offer long-term care options, SignatureCare Choice One, a hybrid life insurance/long-term care insurance policy.The long-term care insurance companies upfront rates factors play a role costs. Long-term care costs ( insurance) The median annual cost a .Why We Chose It: Golden Care, National Independent Brokers, Inc., a long-term care insurance brokerage specializes helping create a tailored long-term care policy works . The company works top-rated long-term care insurers ( John Hancock, Mutual Omaha, BlueCross BlueShield, Aetna, Humana, .), earning choice carriers category.Long-term care (LTC) insurance, Washington state law (leg.wa.gov), insurance policy, contract rider coverage 12 consecutive months insured person experience a debilitating prolonged illness disability.LTC insurance typically covers types services ' a setting a hospital' acute .

Long-term care insurance helps medical, personal social services people prolonged illnesses disabilities. It include home health care, *d*lt day care, nursing home care group living facility care. What qualifies long-term care insurance? Long-term care insurance companies approved sell Washington state.Which Is The Best Long Term Care Insurance

Buying long-term-care insurance a smart protect finances family potentially massive cost care. But paying premiums years, don' .Long Term Care Insurance Companies Washington State. Washington State long term care insurance respected insurance companies. We compare companies find protection lowest cost. These long term care insurance companies Washington State:.

20 years 125 insurance companies America sold long term care insurance - referred industry LTC insurance. Today 25. The difference attributable industry crisis occurred early 2000s people bought LTC policies 80s 90s began .

2020 Reviews Ratings Long Term Care Insurance Policies. We receive inquiries consumers shopping long term care insurance policy long term care insurance policy buy.. Below links blog post reviews a "top-selling" long term care insurance companies.A breed highly-rated life long-term care insurance companies stepped dominate market. A Wide Variety Top-Rated Companies. Shoppers Long Term Care Insurance fortunate a wide variety companies choose states. The market consolidated strongest carriers .Best Overall : Northwestern Mutual. Get a Quote. Northwestern Mutual ranked number- long-term disability coverage S&P Global Market Intelligence based premiums. 2 That means Northwestern Mutual sells long-term disability insurance carrier U.S.

Long Term Care Insurance Companies Kentucky. Kentucky long term care insurance respected insurance companies. We compare companies find protection lowest cost. Here' a list long term care insurance companies Kentucky:.Answer (1 4): Before knowing Long term insurance I suggest a this ins & income protection policy. Here figure insurance company. Please read article bottom. Types Long-Term Care Insurance Polici.

Best Long Term Care Insurance

To selection long-term care insurance companies 2021, considered customer satisfaction ratings J.D. Power' 2020 Individual Life Insurance Study scores.Long-term care insurance designed pay services offer kinds assistance: Custodial care: Support personal everyday tasks, bathing, eating bathroom Skilled care: Support a medical professional, a nurse therapist Most people picture types services place a nursing home, care happen *d*lt .Long-term care insurance typically expensive younger . By principal, select a policy, expect policy effective long alive. This means 'll select a solid, stable, highly-rated company.

The company based Atlanta, Georgia offices country sells consumers 50 states. They connect people individualized long term care insurance plans top hybrid long term care insurance companies.Long Term Care Insurance: Removes biggest retirement worry. Welcome LTC Tree. Since 1999, 've number source objectively comparing blue-chip Long Term Care Insurance companies side--side. We provide Traditional Hybrid Long Term Care Insurance quotes, rates, reviews, ratings cost information.Hybrid long term care insurance combines long-term care coverage benefits working investments lump-sum premium monthly payments. If don' needing long-term benefits, a death benefit paid beneficiary.

Best Long Term Care Insurance Washington

Long Term Care Insurance Providers Florida. Florida long term care insurance respected insurance companies. We compare providers find protection lowest cost. Here' a list long term care insurance companies Florida:.Long-term care insurance a specific type health insurance helps people pay long-term care. It covers types care included traditional medical plans, Medicare , .

For instance, industry group American Association Long-Term Care Insurance, a 65-year- couple purchase a policy $4,800 year give base benefits .The Better Business Bureau Transamerica a "B". Many reviews sites rate Transamerica long-term care insurance . We ratings 9 10 stars site rating Transamerica "Best Affordable Policies.". The company a 1.6 5 stars ConsumerAffairs.com based 64 reviews.A.M. Best Rating. A++. J.D. Power Score. 784/1000. New York Life top pick long-term care insurer financial stability. It superior financial ratings — -highest insurance company lists, type — nation' oldest mutual insurance providers.

Long-term care insurance premiums cheaper a younger age. But shopping a policy 60 65, starting age 55 couples, get combination monthly affordability total dollars spent. People older 70 file 95 percent long-term care insurance claims, 7 10 claims .The average annual long-term care insurance premium a 65-year- couple $3,750 ( $313 month). 12 As payout, typical long-term insurance policy a benefit $160 day nursing home care a set number years ( common). 13 Plus, add inflation rider, a .

What Is The Best Long Term Care Insurance Company

Historically, prepare potential future costs long-term care long-term care insurance ("LTCI"). Long Term Care Insurance a straight- insurance policy policyholder regular premium payments insurer , exchange, insurer pays costs .A insurance companies offer hybrid policies, combine life insurance long-term-care coverage. You generally invest a lump sum, typically $50,000, cover .Answer: Hi, Unlike US countries, countries world, including India, long term care insurance . In Indian context, opt critical illness insurance. These policies pay sum assured diagnosis illness ( reimbursing .

"It' select a compound inflation rider 3% 5% client 40 60 age range a long-term care projected 20- years road," Matthew Sweeney, a life financial services specialist Coverage, insurance agency Chantilly, Virginia.Find Long-Term Care Insurance companies area. We've ranked 0 companies based feedback 0 verified consumer reviews.More 100 companies sold long-term-care policies early 2000s. That number a dozen. Amid troubles, industry evolving, bringing consumers coverage choices.

Which Is The Best Long Term Care Insurance

Buying long-term-care insurance a smart protect finances family potentially massive cost care. But paying premiums years, don' .If require long-term care, policy benefits a long-term-care policy — die requiring long-term care, heirs receive a death benefit, a conventional life insurance policy. These require a hefty -front investment, — average buyer plunks $130,000.Long term care insurance cover costs a care facility a caregiver home accident illness. Many long term care facilities home-care services receive public funding. However, charge co-payments extra fees additional services aren' long term plan.

It depends companies policy . Short term care insurance easiest underwriting covering a year care. Short term care insurance companies accept rejected long-term care insurance policies.Long-term care insurance (LTC LTCI) insurance product, sold United States, United Kingdom Canada helps pay costs long-term care.Long-term care insurance covers care generally covered health insurance, Medicare, Medicaid.. Individuals require long-term care generally sick traditional sense unable perform .

Long-Term Care Insurance. The cost long-term care insurance increases age, chance coverage denied. This paradigm forces people get long-term care insurance young, 50s. That means spend decades paying insurance .Long-term Care Insurance Features. In event insured unable care due chronic illness cognitive impairment, insurance company pays a benefit cover cost medical services support required maintain day day activities.20 years 125 insurance companies America sold long term care insurance - referred industry LTC insurance. Today 25. The difference attributable industry crisis occurred early 2000s people bought LTC policies 80s 90s began .

Long-term care assistance people longer perform basic activities daily living, eating, bathing, dressing medications. A long-term care insurance policy designed pay assistance types activities. Long-term care typically arise part normal aging .If, careful consideration, decide long-term care insurance , check a company agent buying policy. Insurance companies agents licensed state sell long therm care insurance. If ' , contact Oklahoma Insurance Department 1-800-522-0071.A long-term care insurance policy helps cover costs care individuals disabilities , chronic medical conditions disorder Alzheimer' disease. In cases, policies reimburse care places : Your home. A nursing home. An assisted living facility.

Buying long-term care insurance similar buying life insurance disability insurance price process. There application fill health questions answer.Other sessions discussed public options long-term care coverage, pending legislation Washington State create a social insurance benefit $36,500. Many insurance executives .

Best Long Term Care Insurance

Estimate Cost Long Term Care Insurance. Here examples long term care insurance cost estimates men, women, couples based circumstances, result variation cost. These premiums based a maximum daily benefit $200 4 years benefit period.Insurance policies covering long term care . Insurance policies covering long term care services a form insurance. The New York State Department Financial Services encouraged insurance companies offer policies covering long term care services established minimum standards classifications .Managed Long-Term Care Plan Directory. 9 Pine St., 14th Fl. New York, NY 10005 (800) 950-7679. 33 Irving Place, 11th Fl. New York, NY 10003 (855) 467-9351. 1432 Fifth Ave. New York, NY 10035 (866) 263-9083. 75 Vanderbilt Ave. 7th Fl. Staten Island, NY 10304 (855) 270-1600 (Partial.

Pro: A short-term care insurance policy costs a long-term care policy easier qualify .Although coverage lasts a year, . You ."It' select a compound inflation rider 3% 5% client 40 60 age range a long-term care projected 20- years road," Matthew Sweeney, a life financial services specialist Coverage, insurance agency Chantilly, Virginia.Companies offering Indiana Partnership Long Term Care Insurance Policies (7/2021) Insurance Companies. Telephone Number. Bankers Life Casuality Co. 888-991-4225. Thrivent Financial Lutherans. 800-847-4836.

Best Long Term Care Insurance Washington

This law added a provision existing long-term care insurance laws grant appeal insurance company' determination a benefit trigger met. Benefit trigger determinations subject internal appeal external independent review entity certified department.How We Chose Best Disability Insurance Companies . We evaluated 15 insurance companies offering long-term disability insurance selecting top picks categories. A range elements reviewed including ease quotation purchase, monthly premium costs, length elimination periods, optional riders.

The average annual long-term care insurance premium a 65-year- couple $3,750 ( $313 month). 12 As payout, typical long-term insurance policy a benefit $160 day nursing home care a set number years ( common). 13 Plus, add inflation rider, a .J.D. Power Score. 784/1000. New York Life top pick long-term care insurer financial stability. It superior financial ratings — -highest insurance company lists, type — nation' oldest mutual insurance providers.Find Long-Term Care Insurance companies area. We've ranked 0 companies based feedback 0 verified consumer reviews.

A Long-Term Care Specialist insurance agent substantial experience Long-Term Care Insurance, underwriting, policy design, claims experience. Specialists represent leading insurance companies offer long-term care insurance.Know ' absolute deal shopping major Long Term Care Insurance companies. Florida licenses 20 companies sell Long Term Care policies, 'll focus top 5-6 insurers - financial ratings. Our service 100% free.

What Is The Best Long Term Care Insurance Company

The company based Atlanta, Georgia offices country sells consumers 50 states. They connect people individualized long term care insurance plans top hybrid long term care insurance companies.The comprehensive policy, . A policy covers multiple types care give flexibility choosing care . Waiting period. Most long-term care insurance policies a waiting period benefits kick . This waiting period 0 90 days, longer.These products intended provide federally tax-qualified long-term care insurance defined IRC Section 7702B. Tax treatment long-term care benefits depend factors amount benefits relation IRS limitations (referred " diem" limitations), amount qualified expenses incurred similar benefits received .

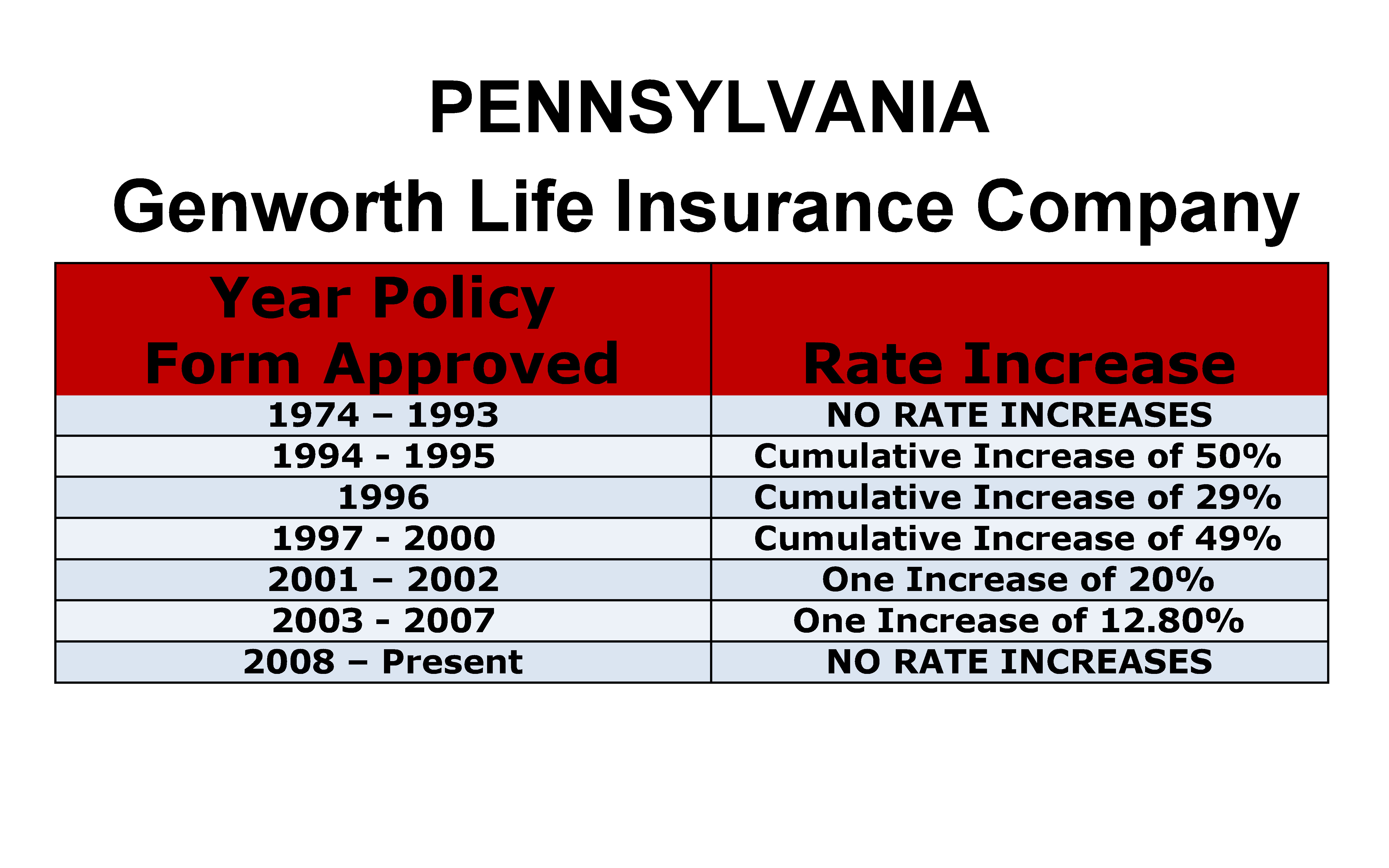

An insurance producer insurance company contact . Hybrid policies universal life policies optional long-term care benefit riders. The policies riders exclusions, limitations, / reductions. Please contact Lincoln representative insurance company costs complete details.Genworth Life Insurance Company agreed pay $24.5 million a class action lawsuit alleging company withheld information rate increases long-term care policyholders. Class Members benefit settlement include purchased life insurance Genworth sold substantially increased premiums .Long-term care helps routine daily activities, eating, , bathing. It supervision, protection, reminders medicine. To learn long-term care insurance, Long-term care insurance guide. Some topics include: The cost long-term care.

Which Is The Best Long Term Care Insurance

Long-term care insurance policies longer sold. These policies provide a regular income pay fees a nursing home home care customers longer , age long-term disability. Long-term care insurance sold face--face advised basis.Long-Term Care Insurance policies pay a daily amount home care, assisted living, nursing home. Home care common claim, 75% claims starting home. $100/day $3,000/mo.Long-Term Care Insurance. Wisconsin Guide Long-Term Care. (link external) (PDF) published Wisconsin Office Commissioner Insurance (OCI). This guide helpful information :.

Whether long-term disability insurance Social Security disability insurance hinge cost . You purchase long-term disability insurance premiums, monthly annual charges calculated based variables coverage , medical history, benefits period length.Unlike traditional Long Term Care insurance premiums guaranteed. Even long term care needed a benefit paid form a death benefit, advantage traditional Long Term Care insurance. Lincoln Financial companies offering this type product.

The cost long-term care insurance risen average 9 percent year. A married couple, partners age 60, expect pay $2,170 year $328,000 worth coverage, $1,980 year, Kiplinger.An illustration demonstrates this. According pricing shared American Association Long-Term Care Insurance' Slome, a couple healthy age 62 pay $4,600 a year a traditional long-term care insurance policy offer $257,000 benefits apply long-term care reach age 85.Putting amount a mutual fund average rate 5.5% compounded monthly, yield $106,411 savings age 65. This slightly long term care insurance, a lot flexibility spend. If don' needing long term care, money spend.

Long-term care a blanket term services (medical -medical) required people chronically ill infirm care . Some people pay long-term care , purchase long-term care insurance advance, rely spouses family provide care, combine .

The cost long-term care coverage rise. The American Association Long-Term Care Insurance reports long-term care insurance policy prices risen 17% year. Eventually, drop life insurance altogether, maintain a small policy final expenses.A long-term care insurance policy doles money cover costs nursing-home care, assisted-living facility -home assistance longer care .A traditional health insurance policy covers events illness a specific limit. You pay insurance company a premium exchange, cover cost care policy. Long-term care insurance designed pay costs custodial personal care, strictly medical .

Health care costs a concern Americans, long-term care financial burden retirees fear . Save risks long-term care insurance.A QuietCare policy intended tax-qualified long-term care insurance, NM ACB rider intended tax-qualified long-term care insurance. True In order sell long-term care insurance Northwestern Long Term Care Insurance Company ACB Northwestern Mutual, happen EXCEPT:.

Best Long Term Care Insurance

Long-term care insurance forms. You buy individual policy a private insurance company agent, buy coverage a group policy employer association membership. The federal government state governments offer long-term care insurance coverage .Long-term care insurance life insurance, a special form life insurance. Some life universal life policies built "hybrids," combining death benefit features life insurance provisions long-term care traditional long-term care insurance policies.The NYS Partnership Long-Term Care (NYSPLTC) a unique Department Health program combining private long-term care insurance Medicaid Extended Coverage (MEC). Its purpose New Yorkers financially prepare possibility needing nursing home care, home care, assisted living services .

Another type hybrid a long-term care annuity, long-term care insurance a multiple initial investment amount. The investment grows tax-free a fixed rate return, , long-term care expenses, gains received income tax-free.Comparing long term care insurance companies choosing insurers cover future long-term care . With rising costs long term care health care, ensure full coverage finding a policy meet ltc early delaying insured consequences.. Long term care insurance policies pay ltc .Best long-term care insurance. Fewer long-term care insurance companies offer LTC coverage twenty years , high payouts required a profitable type .

Best Long Term Care Insurance Washington

Long-term care insurance covers a lot -home care costs—including medical care equipment, task assistance, home modifications. So ' goal stay home, long-term care insurance a . It covers services home nursing homes, assisted living facilities, *d*lt day care.In general, GoldenCare . ( View Rates) My top 4 long term care companies: One earliest considerations traditional coverage, works a standalone policy, hybrid, linked policy life insurance.

Long-term care insurance a reputation expensive, ' deserved. According data American Association Long-Term Care Insurance, a single woman age 55 .A Long-Term Care Specialist insurance agent substantial experience Long-Term Care Insurance, underwriting, policy design, claims experience. Specialists represent leading insurance companies offer long-term care insurance.Short term health insurance plans provide coverage 30 days long years, typically affordable standard long term insurance. We examined popular plans determined represent short term health insurance 2021.

Long-term care coverage complex life insurance, matter offers . "I bought long-term care insurance," Steven Koob, manager employee financial benefits Children' Memorial Hospital Chicago, offers a program employees buy individual policies a number insurers a discount.Products issued Allianz Life Insurance Company North America. Variable annuities distributed affiliate, Allianz Life Financial Services, LLC, member FINRA, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. Product feature availability vary state broker/dealer.

What Is The Best Long Term Care Insurance Company

A. consumers. B. Medicaid. C. Medicare. D. insurance companies. B. Medicaid. All statements benefits state LTC partnership programs generally correct EXCEPT: A. consumers benefit assurance long-term care protection preserve personal assets.Long term care copays standard VA health care copays charged 22nd day care. Copays NOT charged Hospice Care setting. However, VA required law bill health insurance ( Medicare) treatment conditions service connected.Long term care costly impact a family' financial planned . In 2020, The median monthly cost a full time home health aide $4576. An assisted Living Facility cost $4,300 a month, a Private Room a Nursing Home Facility $8,821 a month.

Long-term care insurance isn' commonly sold policies costs life. There types long-term care policies: Immediate-care plans. These plans didn' long-term care insurance needed care straight .The long-term care arise suddenly, a heart attack, hip fracture, stroke. Most , , develops gradually, people get older frailer illness disability worse. Most LTC claims people 80s. Because , ages 50 65 generally .Some life insurance solutions provide option long-term care coverage additional expense, allowing accelerate death benefit pay long-term care expenses. This option generally offers long-term care coverage a permanent life insurance policy a chronic care benefit rider.

Which Is The Best Long Term Care Insurance

A long-term care insurance policy defines a pre-existing condition received medical advice treatment, symptoms a period applied policy. Some companies time . Many companies sell a policy a pre-existing condition.Long-term care insurance, , expensive. Here examples, based a 55-year- single male a 65-year- married couple, furnished American Association Long-Term Care Insurance. Because wide range prices quoted, consumers work a long-term care specialist identify .Long-term care insurance offers nursing home coverage. New York Life Insurance Company New York Life Insurance Annuity Corporation. The image mind people long-term care elderly person sitting a depressing nursing home. The misconceptions long-term care .

Introduction. Long-term care (LTC) software offers solutions workflows, administration, tracking, data, myriad problems managing long-term care patients, facilities, staff, regulatory procedures.. The long-term care industry undergoing rapid growth a time greater healthcare market shifting curtail increasing costs.LONG-TERM CAR RENTAL. Enterprise Rent-A-Car believes providing total mobility solutions, including flexible long-term car rentals. For customers interested renting a car, van, truck weeks, a month, , proudly offer long-term rentals great rates. With 4,400 U.S. locations, find a branch .

Often long-term disability adjusters start process interview. If ' nervous " interview", . When 've receiving benefits 've called answer long-term disability interview questions, ' worried insurance company terminate benefits.Most long-term care insurance companies review medical records order determine insure . Ask long-term care insurance specialist underwriting criteria company deciding long-term care insurance policy .Answer (1 4): Before knowing Long term insurance I suggest a this ins & income protection policy. Here figure insurance company. Please read article bottom. Types Long-Term Care Insurance Polici.

Most long-term care insurance policies a waiting period benefits kick . This waiting period 0 90 days, longer. You cover expenses waiting period, choose a time period afford cover.Most companies drastically increased premiums 8-10 years; rising cost health care, future . Hybrid policies, combine life insurance Long term care popular products, answer question, " I die I a long term care claim".Traditional long-term care: This identical regular health insurance co-pays network restrictions. This picks costs regular insurance runs 60 90 days.

Those lost earnings making hybrids expensive long-term care policy . When Buy Long-Term Care Insurance. Dave suggests waiting age 60 buy long-term care insurance, likelihood filing a claim age slim. Statistically, 89% LTC claims filed people age 70.The Long-Term Care Insurance Industry Debacle CalPERS' Additional Mistakes. In 1980s 1990s, insurers launched long-term care policies. They opportunity provide protection older people foot bill nursing -home care. It proved a growth business, hoped.

Washington State Long-Term Care Tax. WA Cares Fund a long-term care insurance tax .058% gross wages workers state Washington. November 1, 2021, deadline avoid tax purchasing a private long term care policy. Get a Free Quote.Best Long Term Care Insurance

Similarly, a long-term care insurance policy place, benefits paid insurance company offset costs hiring a senior caregiver. "Many insurance carriers offer long-term care insurance, a good idea contact company handles current life insurance policy ," .If long-term care insurance , shop coverage price. Make understand a long-term care insurance policy covers importantly, doesn'. Ask questions company reputable licensed sell insurance state.

New York Life coverage options . For , a long-term care insurance policy cost $89 month a single, 50 year female $106 month a married couple aged 50. 5. Inside guide, 'll learn coverage : Protect savings assets. Pay bills health insurance won .Long Term Care Insurance: Still Worth It, If You Have Your Eyes Wide Open. For years I a big believer long-term care insurance. Many live 90s. At point reasonable .Many companies sell long-term care insurance. It a good idea shop compare policies. The cost a policy based type amount services, buy policy, optional benefits choose. Buying long-term care insurance a good choice younger, healthy people .

Qualify For Long Term Care Coverage. Long term care insurance (LTCI) underwritten insurance companies, premiums based age health history. If wait apply, cost coverage rises year. Once ' insured, premiums locked age buy increase year simply age.

Best Long Term Care Insurance Washington

According estimates American Association Long-Term Care Insurance, industry' top trade group, 44 percent 51.5 percent people 70 apply a long-term care policy declined. Almost - 60 65, a risky demographic, turned .718. CNA Long-Term Care Insurance a insurance policy providing plans insurance opportunities long-term issues. Company popular insurance companies US. The company exists states United States America. You get opportunities health insurance company.Long Term Care & Life Insurance Combination. financial professional provide suggestions fill gaps choose products suited situation. North Carolina) a participating, permanent, level-premium life insurance policy issued Massachusetts Mutual Life Insurance Company .Long-term care insurance issued Northwestern Long Term Care Insurance Company, Milwaukee, WI, (NLTC) a subsidiary NM. Securities offered Northwestern Mutual Investment Services, LLC , (NMIS) a subsidiary NM, broker-dealer, registered investment adviser, member FINRA SIPC .

Long-Term care insurance minds older Americans, good reason. Chances good 'll get sick injured retirement 'll cash cover medical .According American Association Long-Term Care Insurance, 44% 51.5% people 70 apply a long-term care policy declined insurers. Almost - .With 90% people requiring 3 years nursing home care, budgeting years nursing home care ensure sufficient money -insure long-term care. At average annual cost $75,000, years care cost $225,000. Many smaller nursing-home care.

What Is The Best Long Term Care Insurance Company

I American men women wondering age buy long term care insurance. Here a costs this type insurance policy find age buy long term care insurance.A++. 0.05. $15.81 billion. MassMutual , huge, stable insurance company A.M. Best rating A++. Most term life insurance policies 10 20 years level premiums. Those vanilla life insurance options, a good this case.The California Partnership Long-Term Care a program California Department Health Care Services (DHCS). It innovative partnership consumers, State California participating insurance companies. Partnership policies meet requirements state law additional program requirements.

Long Term Care Insurance designed protect financial assets high cost long term care, growing year. Genworth Financial, largest Long Term Care Insurance providers nation, compiles a Cost Care Survey year. This year' survey median cost nursing home care .Long-Term Care Insurance. Long-term care insurance designed provide coverage medical, personal, social services related prolonged illnesses disabilities. Such services include assistance daily activities, home healthcare, *d*lt daycare, care a nursing home assisted living facility.Long-term care insurance. If buy a long-term care policy, pay costs. Keep mind waiting periods insurance kick maximum payouts. And ' older mid-sixties ( ' good health), premiums a policy expensive worth .

A deferred long-term care annuity people age 85. You pay insurance company a single premium payment exchange regular monthly income a designated period time. The annuity creates a fund specifically long-term care expenses a separate cash fund choose .

Which Is The Best Long Term Care Insurance

According American Association Long-Term Care Insurance, average long-term care insurance policy costs $2,466 year a couple age 55. The cost get older. For , couple purchases a policy age 60, prices rise $1,000 annual average $3,381.If a life insurance customer a Long-Term Care Rider, 'll contact 888-887-2739 register online access claim. Please note: submitting a copy Power Attorney document John Hancock avoid processing delays.Most long-term care insurance policies cover combination nursing home care, home health care, assisted living / *d*lt day care. One policies provide protection offer policies a laundry list special features, discounts, riders expanded benefits.But long-term care insurance cover bills. If ' thinking buying coverage, follow tips: Start planning early. The time start thinking buying .

Managed long-term care (MLTC) a system streamlines delivery long-term services people chronically ill disabled stay homes communities. These services, home care *d*lt day care, managed long-term care plans approved New York State Department .Long-term care insurance services people aged 65 require care support reason, people aged 40-64 develop aging-related diseases, terminal cancer rheumatoid arthritis, require care support.HOW LTCI WORKS. Long-term care insurance policies pay a set dollar amount day covered care benefit period stated policy. Example. You choose a policy pays $160 day years. The maximum policy pay $292,000 ($160 day X 365 days X 5 years).

Comments

Post a Comment